The View From Mercury

An overview of the macro conditions impacting VCs and LPs in the coming months.

The Reality

A COVID hangover

The COVID-19 pandemic is waning, but the world must still contend with the virus’ impact on the global economy. In the U.S., effective vaccines and a return to normal activities resulted in increased consumer demand. However, the uptick in spending collided with supply chain disruptions, leading to surging inflation. Despite initial hopes that it was a temporary setback, the higher prices have persisted. As expected, the Federal Reserve responded with a series of interest rate hikes, adding 375 bps to the Federal Funds rate since March, bringing it to 4 percent as we approach the end of 2022. In addition, the quantitative easing that the Fed began in 2009 in response to the uncertainty of COVID-19 ended earlier this year, reducing market liquidity.

Struggles overseas have only added to the current economic volatility and a precarious future for investments. Russia’s war in Ukraine shows no sign of ending soon, putting upward pressure on commodity prices, including crude oil, natural gas and grains. Meanwhile, in China, some of the world’s most stringent COVID-19 restrictions and President Xi Jinping’s aggressive regulation of corporations has resulted in an implosion of the Chinese stock market.

We expect private markets to trend similarly, and soon

Given these unprecedented circumstances, investors are facing uncertain territory heading into 2023. The continued instability of the public markets will likely drive private markets down, significantly impacting VC investment strategies and making exit activity more challenging.

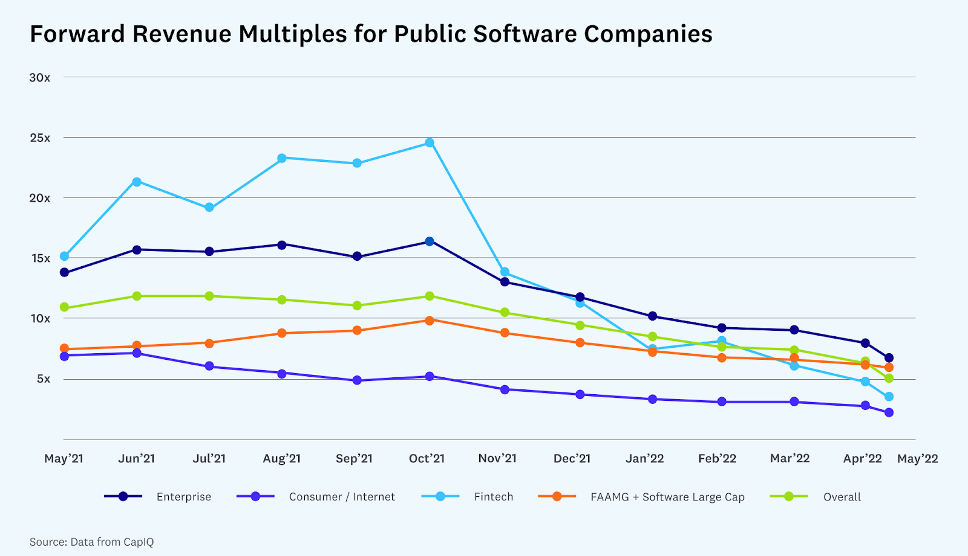

Concerns about valuations dropping began as Q1 of 2022 came to a close. Now, we are seeing that previous anxiety becoming a reality. Many of the public companies that enjoyed significant gains in the past year are reporting Q3 losses on business that haven’t fundamentally changed. And as one of our managing directors, Aziz Gilani, recently pointed out, some of the biggest tech companies are facing tough challenges, with projections showing declines in both revenue and growth for multiple industries.

History tells us that private valuations tend to track public valuations with about a six-month lag. These worsening macro conditions short-circuited a long bull run, and now investors are shifting from a risk-on to a risk-off mode. This shift was initially apparent in the 40-90 percent corrections that some public stocks have already experienced, and the ripple effect is starting to appear in the private markets as well.

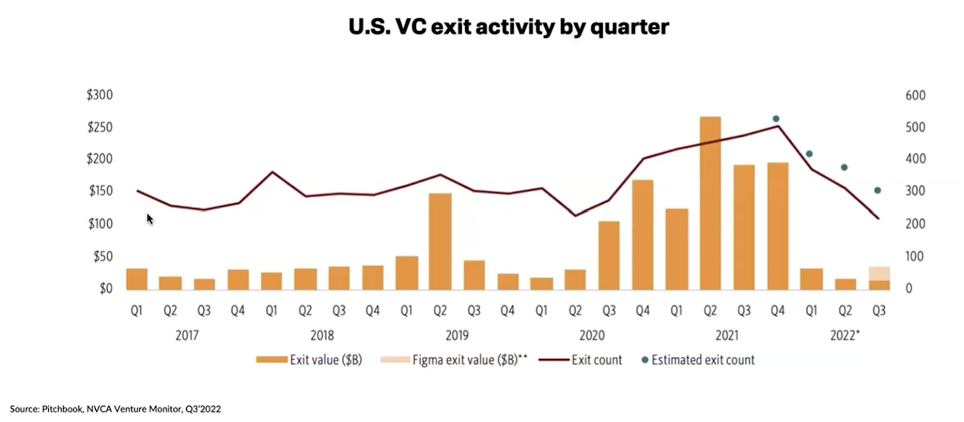

Currently, early-stage VC deal activity and valuations are both down, while late-stage activity and valuations show a less dramatic decline. Still, the reduction in U.S. VC exit activity indicates that a lot of non-traditional investors, like cross-over funds, have paused VC activity.

The Ramifications

VC paradigm shift

We expect the change in LP behavior to result in a flight to quality assets among VCs. The “mega funds” – multi-billion dollar later-stage venture funds that received the bulk of fundraising dollars in 2021 and 2022 – will need to put this capital to work, but they will look to invest in quality. A higher bar for startup funding will force VCs to value results over narrative and demand proof from the companies they are considering investing in. Metrics like profitability and burn rate are becoming the preferred calculus for valuation by cautious investors. Of course, the initial valuations will be unpredictable, but a renewed emphasis on quality will lead to supply and demand pressures supporting higher valuations for the best performing companies.

The search for quality startups able to provide reliable evidence of their potential success will also have VCs changing their targets to align with an economic downturn. Companies that are efficient with their capital, present more opportunity due to their resilience, and can thrive despite the pressures of a recession will become the most appealing prospects.

Already we’re seeing a change in Seed and Series A funding rounds. For example, 2022 Series A financing for companies with $5M-20M run rates sought capital in smaller rounds and much lower valuations than in 2021. This is despite the massive amount of dry powder raised, indicating that VCs will take a more disciplined approach when deploying their cash. These reduced private valuations are one of the indicators that the shift has already begun.

The reality of dry powder

Recently, some investors and advisors have pointed to the extremely high level of dry powder – uninvested funds that are committed but yet to be allocated – as a reason for optimism in the VC world. However, that is a misleading indicator that should not be viewed as a panacea for startups anticipating a recessionary environment.

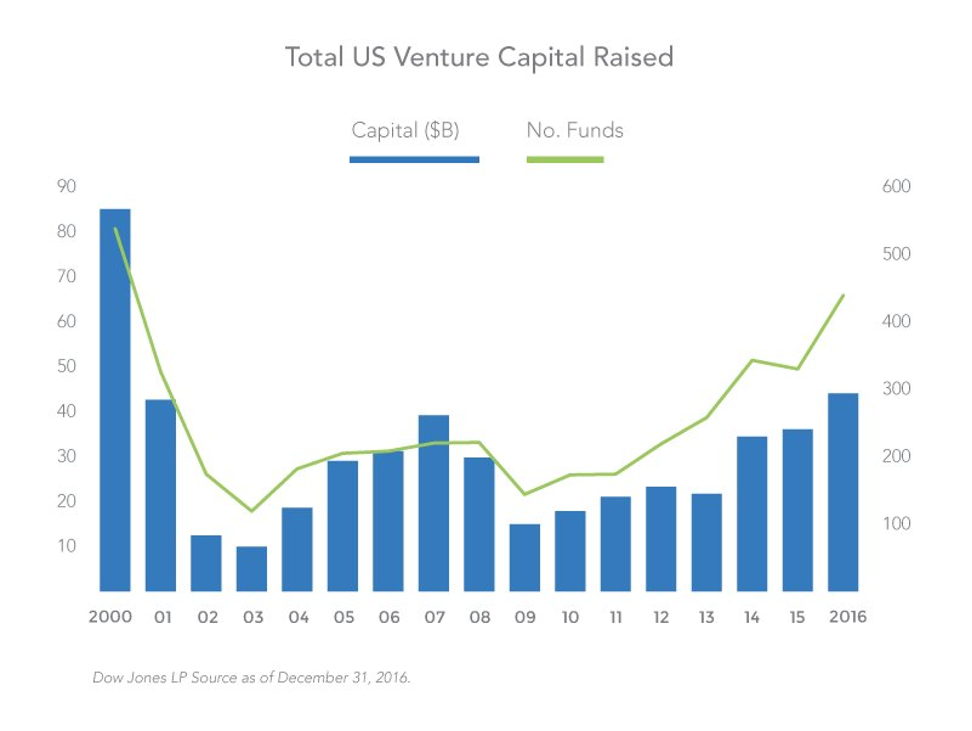

As evidence, we can look back to 2000, a record-setting year for dry powder. Still, the amount of VC money deployed fell for three straight years. We also see a similar pattern when dry powder peaked in 2007, yet investments fell in 2008 and 2009.

To help understand this phenomenon, it’s essential to remember that dry powder doesn’t sit in a bank account waiting to be accessed at a VC’s discretion. It has to be called upon by an LP, and LPs typically have strong opinions, especially amid a volatile market.

In addition, VCs are slowing, and in some instances halting, their investment pace just as fundraising is slowing and multiples are falling. Meanwhile, startups are preparing for a downturn by switching from growth to cash-flow mindsets and may need funding to bridge this transition. A vast majority of VCs will first opt to fund the stability of their own portfolio rather than invest in new startups. Those that do will likely be more calculating with the rest of their capital and wait for signs of stabilizing valuations.

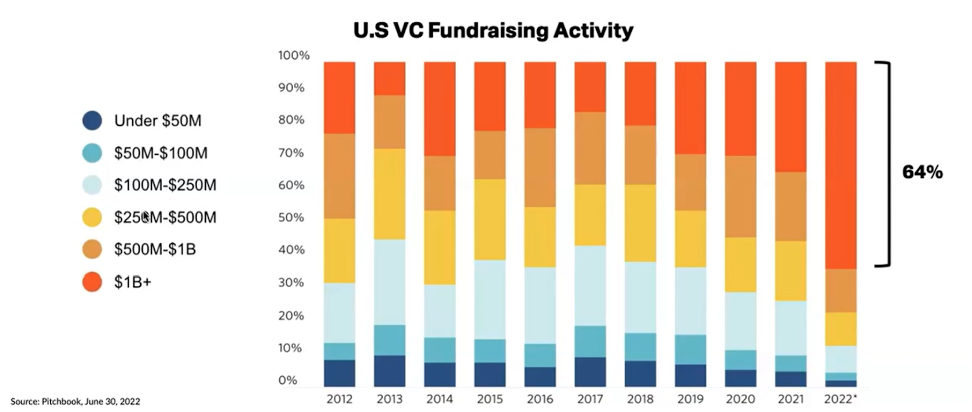

Fundraising has also slowed for smaller and emerging funds. Instead, much of the investments are going to the largest VC funds, with 64 percent of all VC capital raised this year heading to the mega funds, a jump from the 35 percent of funds they received in 2021.

Exit Environment

As Frank Rotman, co-founder of QED Investors, recently made the case for, VCs were previously underwriting based on the promise of inflated funding rounds with little data to back up the increasing valuations. The frothy approach led to groundbreaking IPO activity and acquisitions at incredibly high valuations.

Of course, none of this was sustainable. Now, the exit environment is unfavorable, and blood is in the water. The potential for mergers and acquisitions is minimal, giving the upper hand to corporates and funds with solid balance sheets and an interest in bargain hunting.

The Response

Time to prepare

It’s impossible to know exactly what comes next, but we can say it’s not too early to prepare for a tightening capital environment. First, startups should be looking to drive capital efficiency by lowering operating expenses and extending cash runways to 18 months or more. It’s a necessary response to the changing fundraising environment that will make new investments uncertain.

Justin Kahl and David George of a16z also recommend creating plans for base, best and worst-case scenarios. The base case response of a slight slowdown or continuation of the status quo occurs when you meet the efficiency and growth goals that you believe were attainable. Exceeding those goals means you can increase operational expenses and investments, while a miss means implementing a worst-case response of cutbacks that will slow the company’s burn rate. The key is having a plan for each scenario in place before you’re forced to react to market fluctuations.

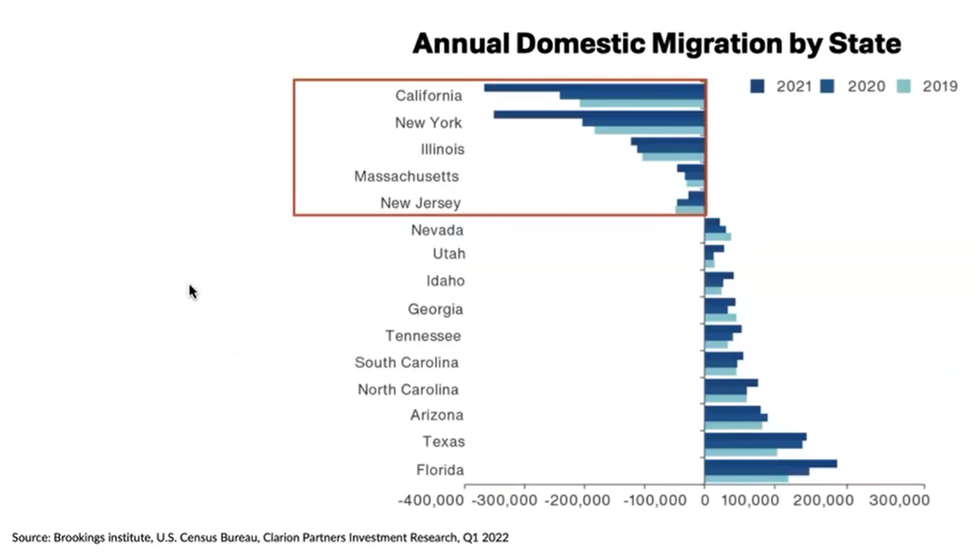

This is a market that can benefit from recent demographic shifts. Despite economic pains, one bright spot for many founders we work with is the recent rise in talent migration happening across America. Out-migration from high-tax coastal states is feeding more robust growth in some small-and-mid-sized cities and the suburbs of Sun Belt Markets. The influx of people makes it easier for startups in these areas to upgrade their teams.

Regardless of geography, businesses should begin focusing on expenses as much as revenue and tighten projections to better prepare for what may be required over the next 12 to 18 months. Startups should be ready to share significant amounts of proof supporting their viability and realize that any amount of anti-proof might be enough to scare new investors away. Instead, founders will need to place a premium on VCs who already believe in their thesis and understand the dynamics of their ecosystem.

Go Slow to Grow Fast

Moving forward, our team will continue to employ our Mercury Method framework to guide our investments. The Mercury Method is our proprietary framework by which we evaluate startup investment opportunities. After standard diligence on a company has been completed, Mercury assesses a startup on key operational fundamentals that are necessary for sustainable, healthy growth. If these fundamentals aren’t in place, we slow the company down to fix what ails them before they begin adding resources for scale, and with that, burn rate.

We think the current economic environment is an opportunity for most startups to benefit from this attitude. By slowing down our startups at a pivotal stage, we can address any operational process deficiencies early with our playbooks and network of best-in-class fractional executives and consultants. The result is operationally clean and scalable startups that grow faster and fail less often than their early-stage counterparts. For more information about our commitment to building successful, scalable businesses, visit MercuryFund.com.