This article was originally featured on VentureBeat

Two years ago, the $2 million seed round was unheard of—a funding unicorn of sorts. Today, you hear about a new one every day.

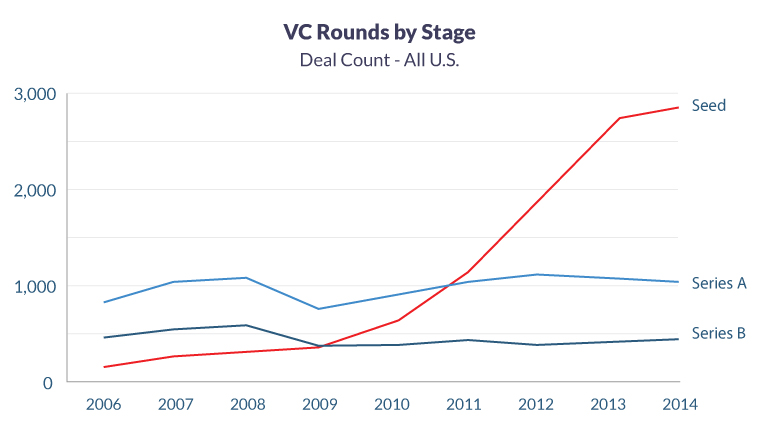

As seed rounds swell, the number of Series A and B rounds remain the same, leading to the now-familiar Series A crunch.

The crunch is a daunting, if surmountable, barrier for coastal startups. For startups in Middle America, it is the Valley of Death.

Stranded between funding trends, these regional startups are left without the resources they need to define their companies as long-term investments. Unlike consumer-facing startups, which are difficult to justify being located away from the coasts, many of these startups have a “reason” to have been launched in the middle of the country. They are B2B software startups (almost always SaaS) and are poised to disrupt the mainstays of American industry — manufacturing and energy, among others — but are stalling before the A-stage for lack of further funding opportunities.

Given the economic importance of Middle America, that’s not just bad for entrepreneurs. It’s a domino effect that’s bad for America.

For the complete article, featured in VentureBeat, please click here