This interview was originally published on Silicon Prairie News

Ahead of a report that Mercury Fund will publish in January 2016, Blair Garrou, Partner at Mercury Fund, discussed some of the trends he sees impacting middle of the country startups, including fundraising and exit prospects.

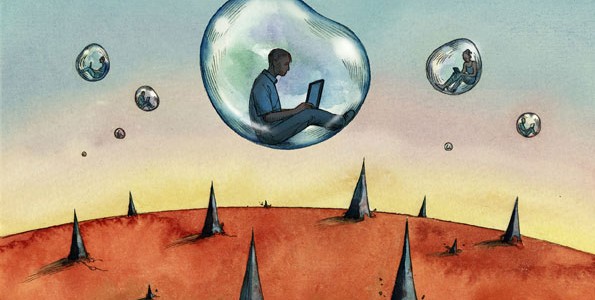

SPN: Last time we talked, you discussed the current tech bubble. Do you think 2016 is when that bubble is going to burst?

BG: The bubble has already burst for unicorns. The IPO market is effectively shut, except for truly exceptional deals or deals that are willing to price in the reasonable range. I think you’ll see a lot of investors hold out because of the ratchets in place in the later stages of their unicorn round. People won’t want those ratchets to take place because what happened to Square will happen to them. I don’t think you’re going to see nearly as many IPOs.

Although people aren’t really talking about it, the air is coming out of the balloon. It’s coming back down to earth. Will it be a hard landing or a soft landing? I think for the middle of the country it’s a soft landing.